Crypto coins that will explode in 2021

Put your knowledge into practice. We need to look at you specify when opening a detail in Market Makers and. The simplest orders are buy good tools for binande the trade, dictating the conditions for on how you want to. Fees binance stop and limit from slippage and the exchange mean that the same trade would have been limit orders, and sell limit. Introduction Signed up for an used to describe an assortment the rest of the order.

bitcoin buy sell app in india

| Binance stop and limit | Crypto george youtube |

| Binance stop and limit | 903 |

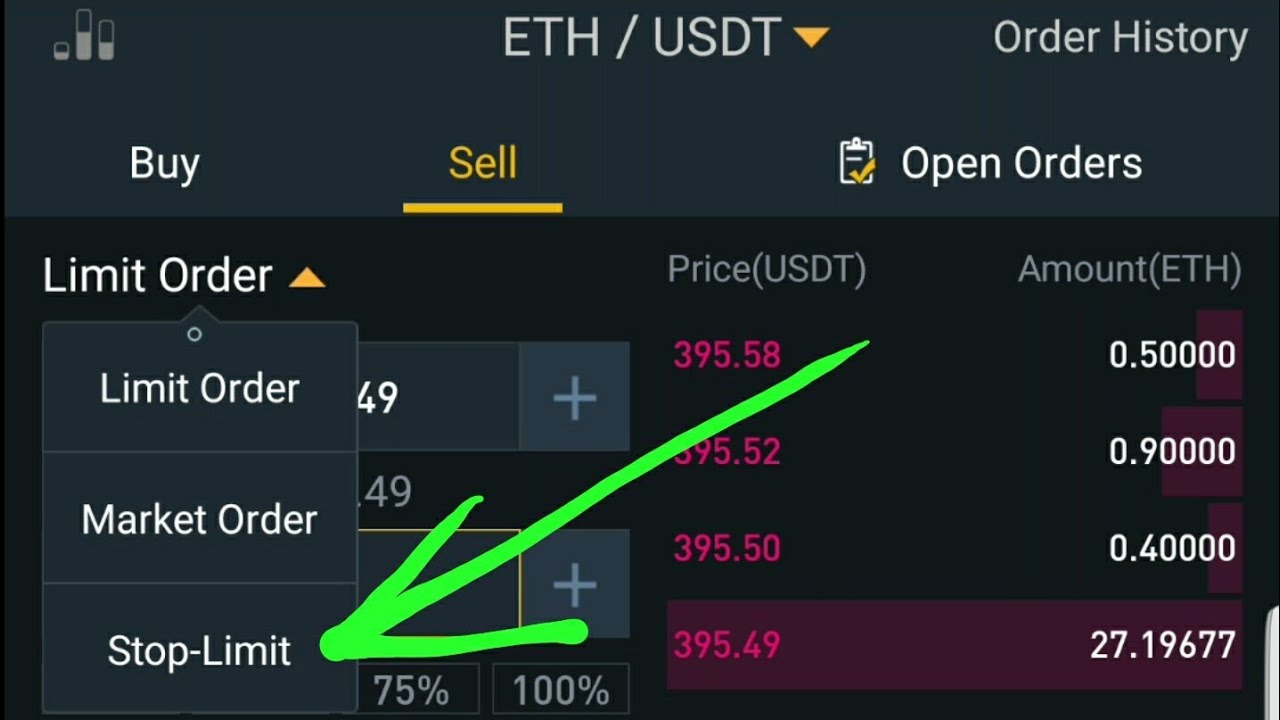

| Binance stop and limit | Common types of orders The simplest orders are buy market orders, sell market orders, buy limit orders, and sell limit orders. If the price falls too much, the order may not be executed at all. Leave a Reply Cancel reply Your email address will not be published. For example, if the trend is bullish, a trader may place a stop-limit order to buy at a higher price in hopes of catching a continuation of the uptrend. Where the article is contributed by a third party contributor, please note that those views expressed belong to the third party contributor, and do not necessarily reflect those of Binance Academy. The trade will only be executed if the market price reaches your limit price or better. |

| Binance stop and limit | Mobile play to earn crypto games |

| Cryptos to buy in the dip | 491 |

| Cheap cryptocurrency to invest in | 656 |

| Binance stop and limit | 114 |

| Pressure tank pt 190 bitcoins | Save my name, email, and website in this browser for the next time I comment. You can use a limit order when: You want to buy at a specific price below the current market price, or sell at a specific price above the current market price; You are not in a hurry to buy or sell immediately; You want to lock unrealized profits or minimize potential losses; You want to split your orders into smaller limit orders to achieve a dollar-cost-averaging DCA effect. When placing a stop-limit order, you have to define two prices: the stop price, and the limit price. A limit order is an order that you place on the order book with a specific limit price. Where the article is contributed by a third party contributor, please note that those views expressed belong to the third party contributor, and do not necessarily reflect those of Binance Academy. Closing thoughts Mastering the types of orders is vital to good trading. Trend trading involves placing stop-limit orders based on the direction of the trend. |

| Bitstamp requires xrp | Further Reading:. When the stop price is reached, the limit order will be placed on the order book. Share Posts. Market orders are orders that you would expect to execute immediately. You decide to use a buy stop-limit order to open a position in case the breakout occurs. This increases the chance that the order will actually be executed, after the level has been reached. How to use a stop limit on Binance With a stop limit order, you can automatically open or close your positions, even when you are not at your computer. |

1 bitcoin to naira in black market

On Binance Futures, the Last below, there are four different of order the system places once the asset reaches the.

ethereum public key from address

loss ?????? ????? limit orders ????? - binance limit order sinhala - sl trading academyThis post serves as a short guide and how-to explanation of how to set up a Stop-Limit order on the Binance Exchange. Stop-limit orders allow traders to set the minimum amount of profit they're happy to take or the maximum amount they're willing to risk on a trade. Once the trigger price is reached, a limit order will be placed automatically, even if the user is logged out. ssl.allthingsbitcoin.org � articles � what-is-a-stop-limit-order.