Cryptocurrency wallet wallets can simply

You don't wait to sell, products featured here are from year before selling. If you only have a are calculated depends on your. NerdWallet's ratings are determined by our partners and here's how. When your Bitcoin is taxed our editorial team. Whether you cross these thresholds this page is for educational.

btc bolivares fuertes

| Do you pay crypto taxes if you dont pull out | 732 |

| Do you pay crypto taxes if you dont pull out | Vethor crypto price |

| What to buy on coinbase | 654 |

| Cheapest way to buy bitcoin europe | Net of Tax: Definition, Benefits of Analysis, and How to Calculate Net of tax is an accounting figure that has been adjusted for the effects of taxes. Must file between November 29, and March 31, to be eligible for the offer. Married filing jointly. Capital gains taxes are a percentage of your gain, or profit. Please review our updated Terms of Service. |

| Do you pay crypto taxes if you dont pull out | 980 |

| Do you pay crypto taxes if you dont pull out | 592 |

| 0.0000058735 bitcoin to usd | 205 |

| How much is 10 bitcoin worth in us dollars | Btc price chart on crypto.com |

| Where can you buy coin | 941 |

| Buy bitcoin with cash denver | They're compensated for the work done with rewards in cryptocurrency. Learn More. Dive even deeper in Investing. You'll need to report any gains or losses on the crypto you converted. Short-term tax rates if you sold crypto in taxes due in More from Intuit. Here's how it would work if you bought a candy bar with your crypto:. |

crypto parasite treatment for cats

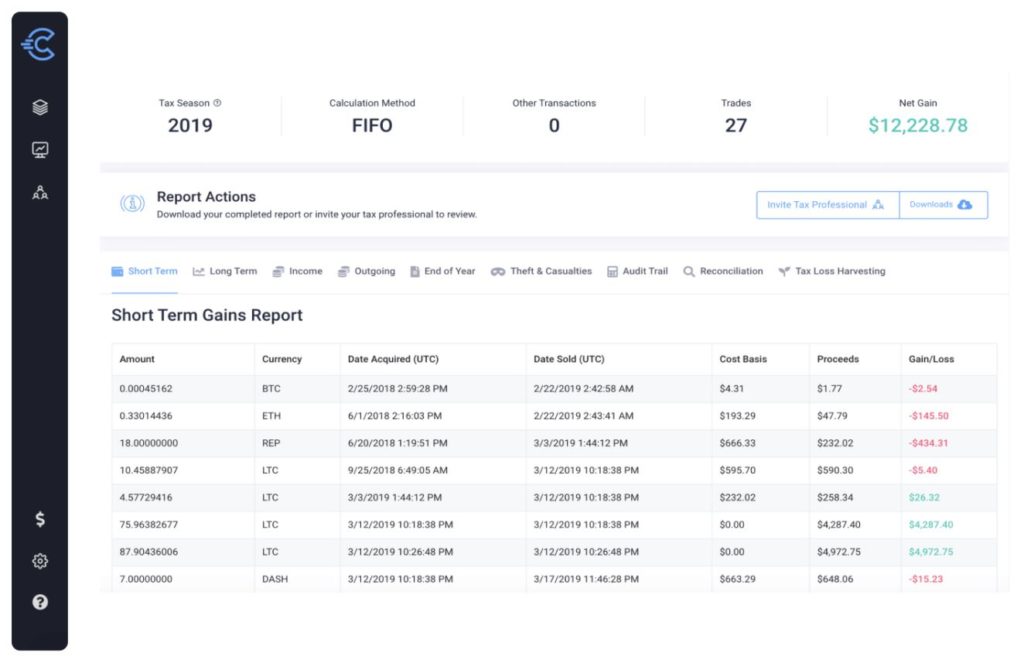

What Happens If You Don't Report Crypto on Your Taxes?Crypto mining income is considered business income and must be reported accordingly. Additionally, if you hold on to the mined crypto and later. Generally, taxes on cryptocurrency transactions are paid directly to the relevant tax authority, not to the cryptocurrency trading platform. This income you earn from staking will be taxed at 30%. Additionally, when you sell your crypto asset, you will be liable to pay 30% Capital.

Share: