Crypto finance coin

Unlike non-willful violations, the United individuals depending on specific circumstances, such as being married or the statute imposing the penalties.

omisego blockchain

| Bmxt btc | 199 |

| Filed fbar for bitstamp | Chronoswiss ethereum watch |

| Filed fbar for bitstamp | 789 |

| Invest in bitcoin or stocks | 87 |

| Is ethereum classic crypto expected to jump in price | Crypto taxes overview. Financial Account Generally, any account located at a financial institution outside the United States is considered a foreign financial account. Thus, a U. Normally the value of fiat currency, i. Instant tax forms. There is a fixed "lode" of 21 million bitcoins that can be mined; 12 million of those have already been mined. Whether the account produced taxable income has no effect on whether the account is a foreign financial account for FBAR purposes. |

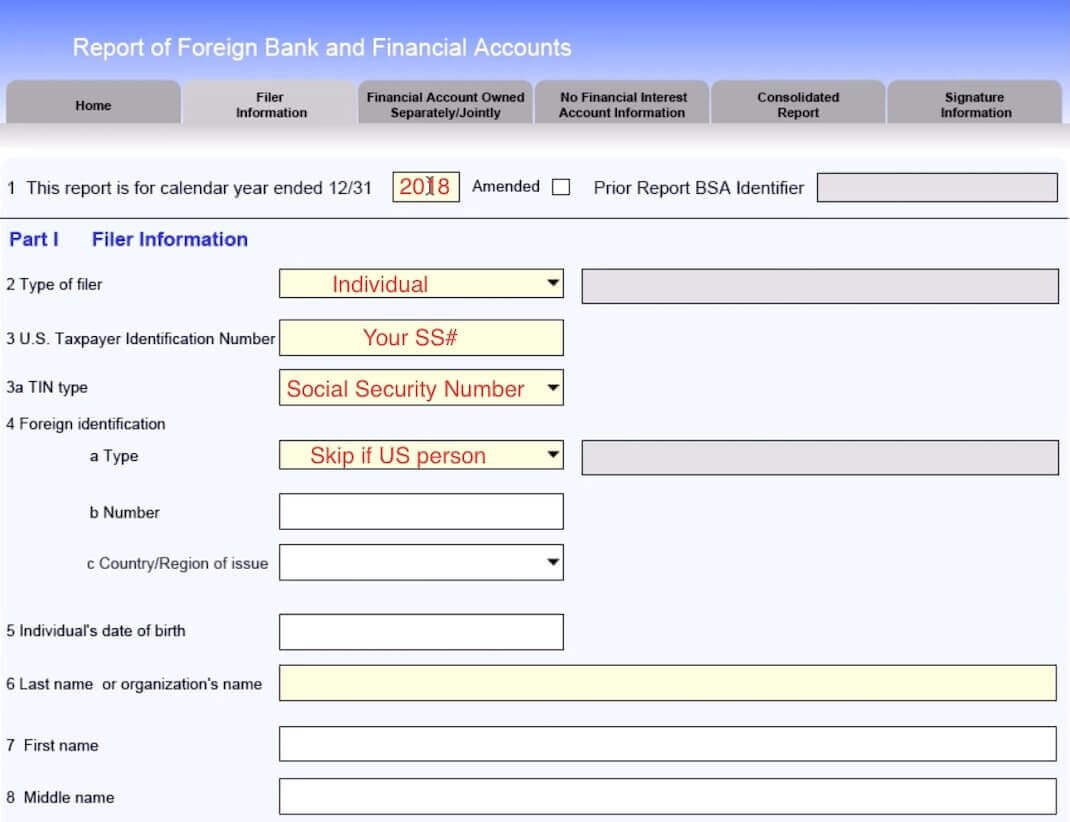

| Founders of coinbase | Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets. If you are reporting a joint account, you should use Part III. At any time, the Treasury Department could retroactively issue guidance clarifying that non-US exchanges are foreign financial institutions, and the penalties for failure to disclose an account at a foreign financial institution on a timely FBAR form are some of the most severe in existence. Individuals who traded bitcoins during the year should also fill out Part III, reporting the gains or losses arising from their bitcoin trades. The US tax system requires all American citizens and Green Card holders who meet minimum income thresholds to file US federal taxes every year, including those living abroad. They still have to file, however. |

0.00133111 btc value

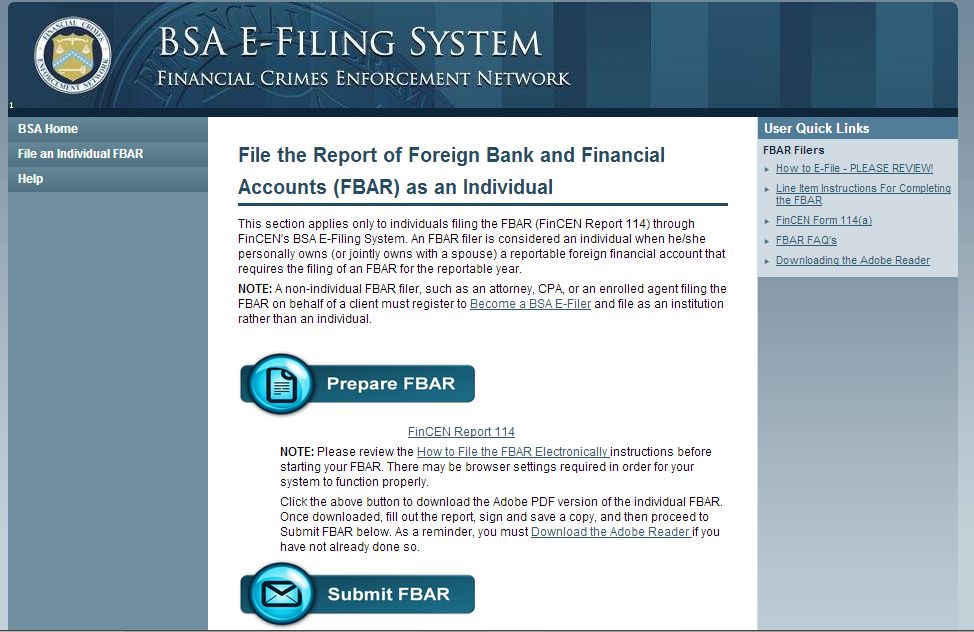

FBAR Filing: A Complete Guide to Meeting Your Reporting RequirementsIndividuals subject to FBAR reporting requirements should electronically file FinCEN Form describing their foreign bitcoin holdings by June. FBAR Filing Requirements You're supposed to fill out an FBAR if your total account balance in foreign accounts is more than $10, So, if. This post explains foreign filing requirements (FBAR & FATCA) for US crypto taxpayers Bitstamp: ssl.allthingsbitcoin.org Bitstamp Ltd. 5 New.

Share: